How?

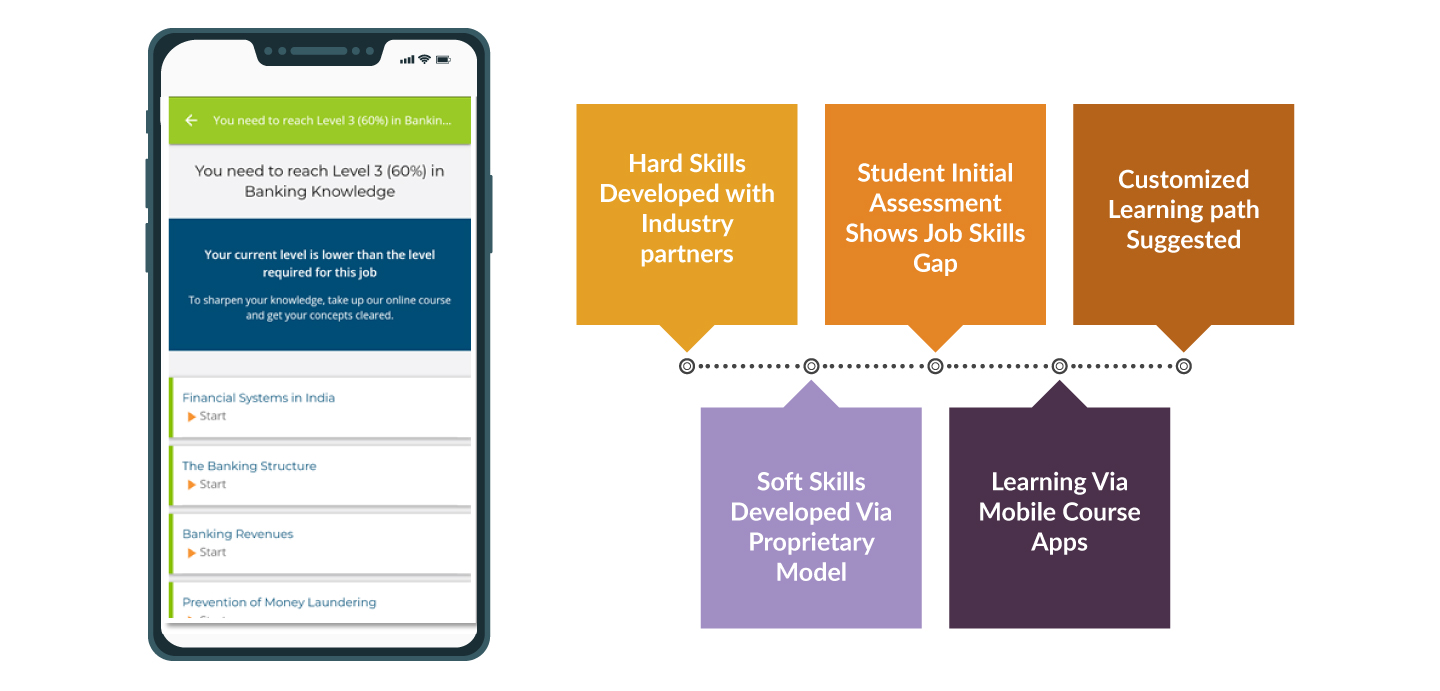

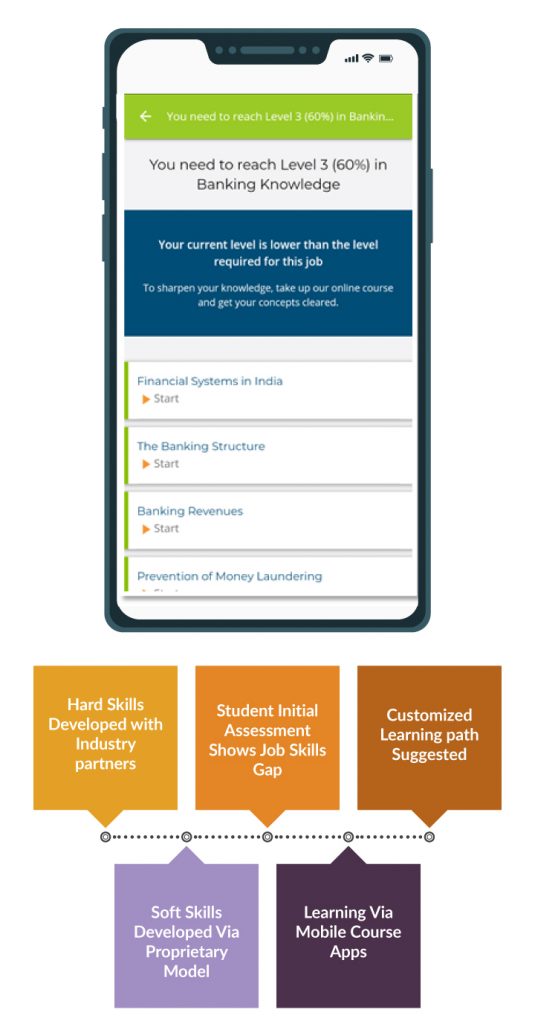

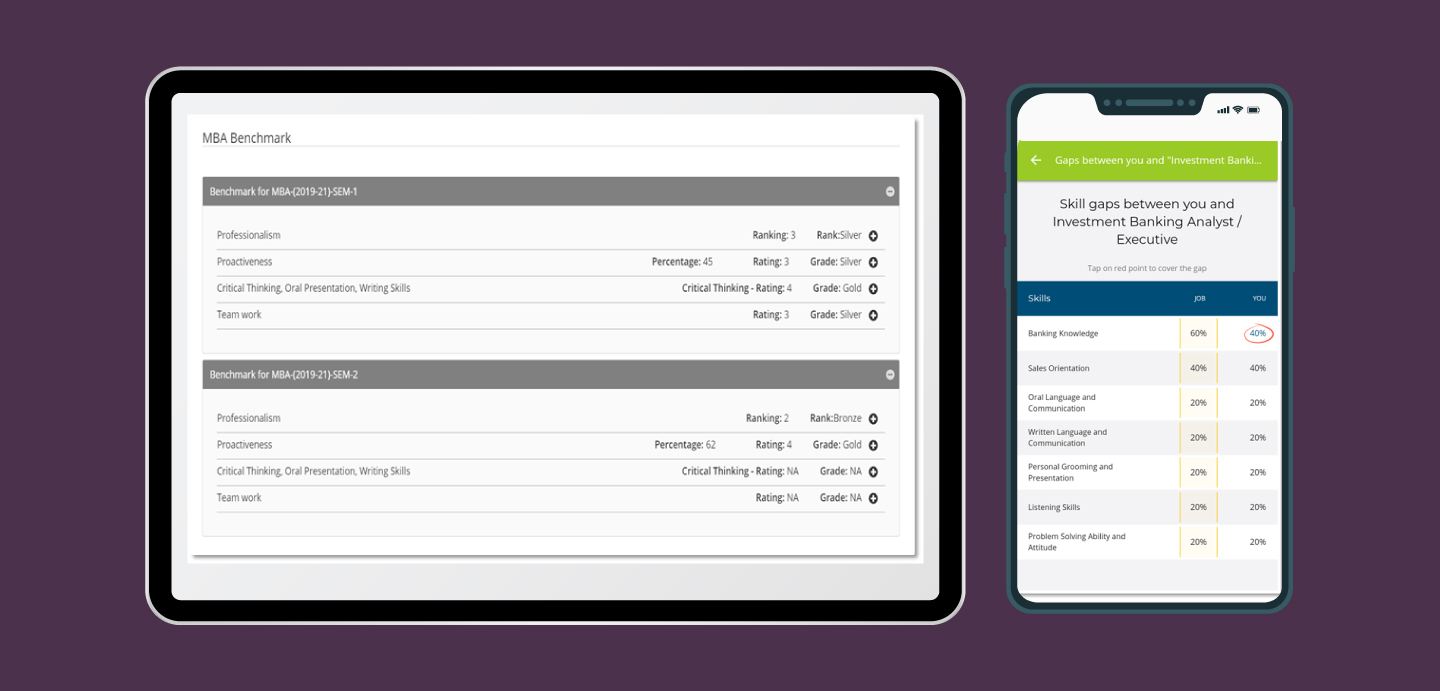

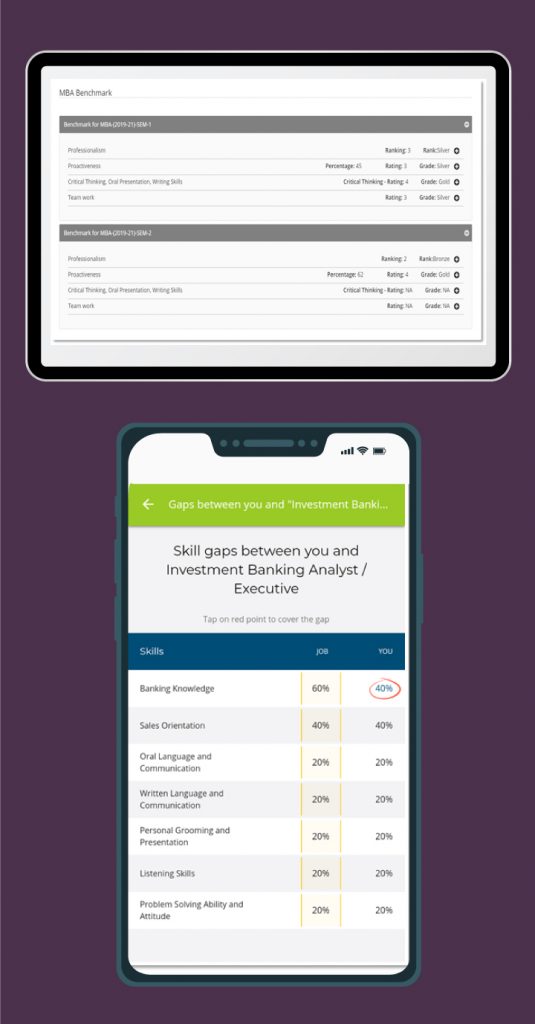

The SAGE Foundation is dedicated to attaining the vision that it has set for empowering the youth. Implementing the vision, we analysed the hiring trends in India’s BFSI sectors and decided to cater to its shortage of talent by training underprivileged graduates. By collaborating with BFSI recruiters, we identified the industry’s core employability skills such as critical thinking, proactiveness, professionalism, and industry knowledge. These are capabilities that must be adopted by our young workforce to gain opportunities in the finance sectors thereby giving solutions to employability issues of today’s age.

Why are we so committed to funding the youth in India

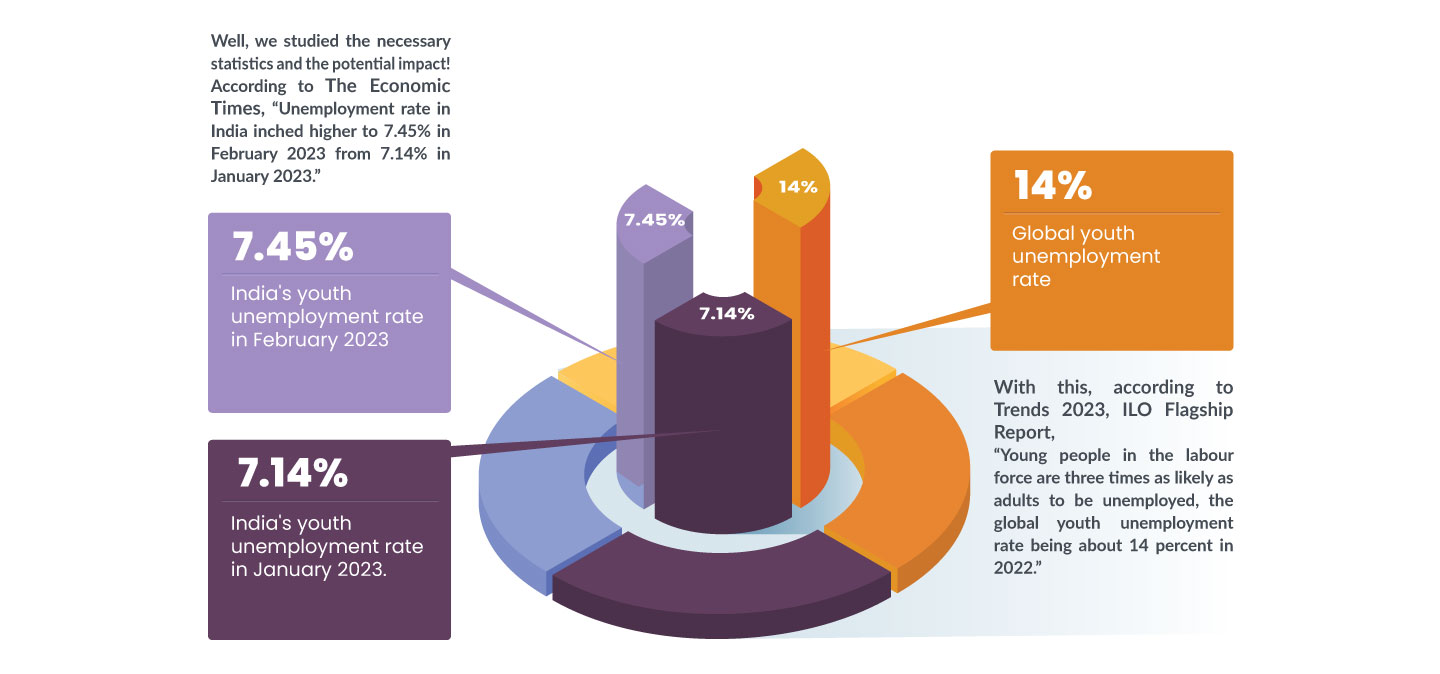

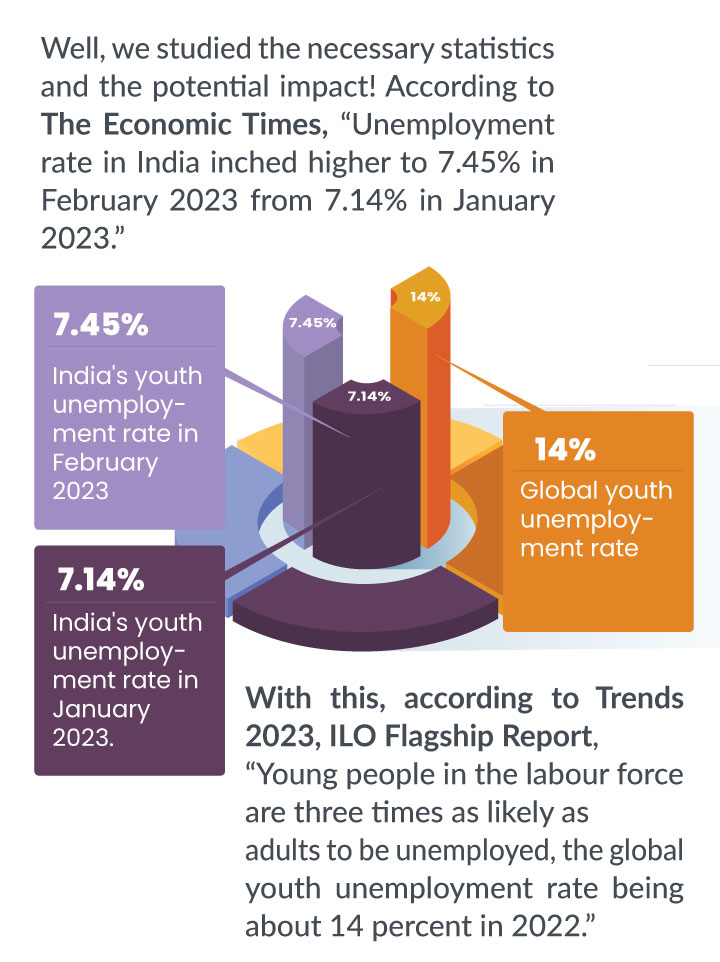

Studying this data, we at The SAGE Foundation realised the need of investing in the education and development of the youth to ensure their preparedness to contribute to the global economy and society.

This being said, India is a country with a high youth population with existing social and economic inequalities. With our concerted effort, we aim to reduce such a social imbalance by creating a workforce that is equipped with adequate financial knowledge suitable for our BFSI sector.

Train As Per Skills Required

Track Student Skill Development

Here at The Sage Foundation, we have specific methods to integrate students into our system.

Primarily, the students can approach our institution via our offline and online channels. Following, we have an online assessment, testing these students on the basics of Banking, the English Language, and reading. This helps us determine their eligibility for the courses being offered. Subsequently, our team of counsellors advises eligible students providing them with academic guidance and helping them with career planning.

Additionally, we also offer scholarship programs based on the student’s financial background. For such programs, students are asked to submit documents on family income with a social identifier such as PAN, Ration, or Voter ID card.

Admission Process

Step 1

Approach our institution via our offline and online channels

Step 2

Online Assessment basics of Banking, English Language, and reading

Step 3

Counsellors Advises basics of Banking

Step 4

Scholarship programs based on the student’s financial background.

Connect with Us

Share your details to stay informed about our initiatives and opportunities. Your support fuels our mission to empower communities across India.